Inox Wind Share Price | More Than Just Hype? Decoding the Monster Rally

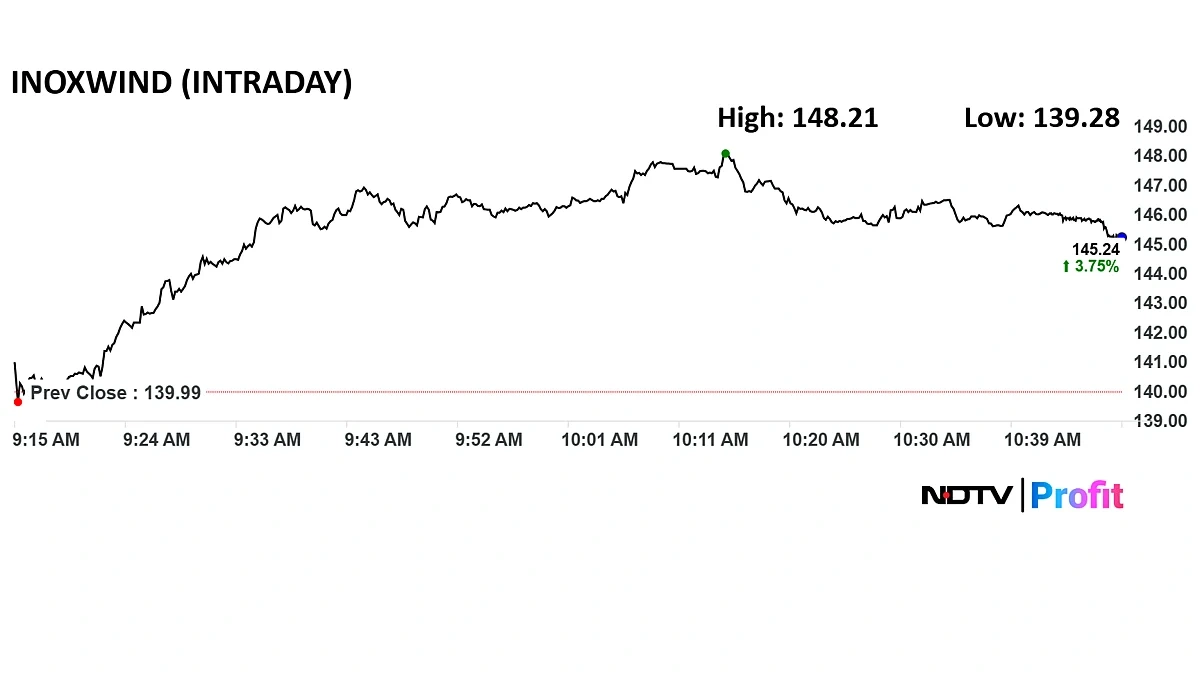

Let’s be honest, you’ve seen the chart. It looks less like a stock and more like a rocket launch. The Inox Wind share price has gone absolutely vertical over the last year, turning early believers into heroes and leaving everyone else wondering, “What on earth did I miss?”

It’s the kind of stock performance that lights up social media, gets whispered about in investor forums, and makes you second-guess every investment decision you’ve ever made. But here’s the thing about rockets: they either reach orbit or they burn out spectacularly.

So, as your friend in this chaotic market, let’s sit down and actually figure this out. Is this just another meme stock rally fueled by hype, or is there a genuine, powerful business turnaround story happening here? We’re going to go beyond the ticker tape and unpack the why behind this incredible run. Because understanding the ‘why’ is the only thing that separates smart investing from pure gambling.

The Turnaround Story You Weren’t Watching

To really get what’s happening now, you have to understand where Inox Wind came from. For years, it was… well, let’s just say it wasn’t the star of anyone’s portfolio. The company was saddled with enormous debt, faced brutal competition, and struggled with operational issues. The entire wind energy sector, in fact, was going through a rough patch with policy uncertainties and aggressive bidding that squeezed margins to dust.

Many investors (myself included, initially) had written it off. It was a classic “value trap” a stock that looks cheap on paper but keeps getting cheaper for very good reasons. The balance sheet was a mess, and profitability was a distant dream.

But then, something started to shift. It wasn’t one single event, but a series of deliberate, crucial changes that began to turn the massive ship around. The management team initiated a ruthless focus on cutting down debt. They cleaned up their operations. And most importantly, the external environment the very winds that power their turbines began to blow fiercely in their favour.

Unpacking the “Why” | The Three Big Tailwinds Powering Inox Wind

A 10x rally doesn’t happen in a vacuum. It’s usually a perfect storm of a company fixing its internal problems right as the entire industry gets a massive boost. For Inox Wind, this came in the form of three powerful tailwinds.

1. The Government’s Green Megaphone

This is the big one. India has set some of the most ambitious renewable energy targets on the planet. The government is screaming from the rooftops that it wants to achieve 500 GW of non-fossil fuel energy capacity by 2030. You can see the official commitment on the Ministry of New and Renewable Energy website. This isn’t just a fancy headline; it’s a massive, multi-trillion-rupee industrial policy.

What does this mean for a company like Inox Wind? It means predictable, long-term demand. The government shifted from a painful reverse auction mechanism to a more stable bidding process, ensuring companies could actually make a profit. This policy shift was the green light the industry had been waiting for, creating immense visibility for future projects and making renewable energy stocks in India hot property. It was like going from sailing in a hurricane to having a steady, powerful trade wind at your back.

2. The “Order Book” That Became a Fortress

If government policy is the wind, the order book is the sail. An “order book” is simply the total value of confirmed orders a company has yet to fulfill. For a manufacturer, it’s the single most important indicator of future revenue.

And Inox Wind’s order book has become a fortress. They have secured massive orders from major players like NTPC, CESC, and other PSUs. Their Inox Wind order book is now in the multi-gigawatt range, providing revenue visibility for the next several years. Think about that. The market is no longer guessing if Inox will have business; it knows for a fact that the company is booked and busy for the foreseeable future. This certainty is what attracts big investors and drives a re-rating of the stock.

3. The Merger Magic & A Cleaner Balance Sheet

This part is a bit technical, but it’s absolutely critical to the story. Recently, Inox Wind completed its merger with its parent company, Inox Wind Energy. Let me translate that from corporate-speak to plain English. The move simplified a messy, complicated corporate structure. More importantly, it helped the company significantly deleverage its balance sheet, effectively wiping out a huge chunk of debt and strengthening its financial health overnight.

A company with a clear structure and low debt is infinitely more attractive to institutional investors (the “big money”). The Inox Wind merger was the final piece of the puzzle, signaling to the market that the turnaround wasn’t just talk it was a financial reality.

Okay, So What Are the Risks? (A Necessary Reality Check)

Now, before you get carried away and plow your life savings into the stock, let’s take a deep breath. A stock that has run up this much is carrying sky-high expectations. The question is no longer “Will it survive?” but “Can it deliver on this immense promise?”

The primary risk is execution . Having a 2,000 MW order book is fantastic. But can they actually manufacture, deliver, and install all those turbines on time and within budget? Any delays or cost overruns could severely impact profitability and spook investors. This is where the company has to prove its operational excellence.

Second, there’s competition . The wind energy space is heating up. Suzlon Energy, another company with its own incredible turnaround story, is a formidable competitor. There are also global giants like Siemens Gamesa. The market is big, but it’s not a monopoly.

Finally, there’s valuation . Let’s be blunt: Inox Wind is not a “cheap” stock anymore. The market has already priced in a lot of the good news. For the Inox Wind share price to keep climbing, the company can’t just meet expectations; it has to consistently beat them. That’s a high bar to clear. Some people wonder why is inox wind share falling on certain days; it’s often just profit-booking and a natural market reaction after such a steep climb.

FAQs About Inox Wind Share Price

Why did the Inox Wind share price go up so much?

It’s a combination of three main factors: a major industry tailwind from India’s green energy policies, a massive and growing order book ensuring future revenue, and a successful corporate merger that cleaned up the company’s balance sheet by reducing debt.

What is the impact of the Inox Wind merger?

The merger with its parent company, Inox Wind Energy, simplified the corporate structure and, most importantly, made Inox Wind a net-debt-free company. This financial strength makes it much more attractive to large institutional investors.

What is the latest news on the Inox Wind order book?

Inox Wind has consistently won large orders from public and private sector companies. Their order book is currently over 2.7 GW, which provides strong revenue visibility for the next 2-3 years and is a key driver for the positive outlook on the Inox Wind future .

Is Inox Wind completely debt-free now?

Following the merger and a recent fundraising round, Inox Wind has become a net-debt-free company on its balance sheet, which is a significant milestone and a massive improvement from its previous high-debt situation.

What are the main risks for Inox Wind moving forward?

The primary risks are execution (delivering on its huge order book on time), rising competition from other major players in the wind energy sector, and the stock’s high valuation, which means it needs to consistently exceed market expectations.

Understanding the broader market context is also key. A concept like what is Nifty helps you see how individual stocks fit into the bigger picture. Similarly, analyzing other turnaround stories, like this NMDC share price analysis , can provide valuable perspective.

The journey of the Inox Wind energy share price is a classic market tale: a fallen angel finding redemption through a combination of internal discipline and a powerful external tailwind. The stock chart tells you what happened. The story behind the government policies, the bulging order books, and the cleaner financials tells you why.

The question for investors today has fundamentally changed. It’s no longer, “Is this a good company?” The market has answered that with a resounding ‘yes.’ The real question you have to ask yourself now is, “At this price, how much of India’s incredible green energy story am I willing to bet on?”